Increasing worry about the unpredictability of US policy is prompting overseas investors to look to diversify away from US and hedge against US assets, also China has been striving to accelerate international use of its currency CNY, presenting itself as a dependable alternative.

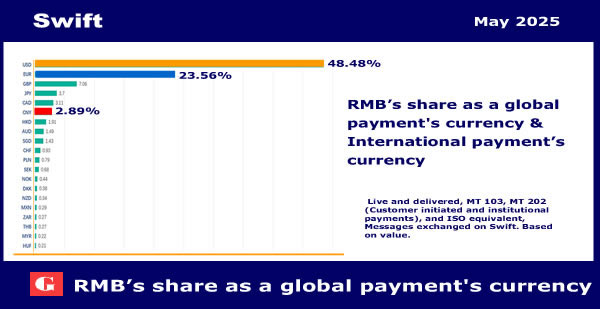

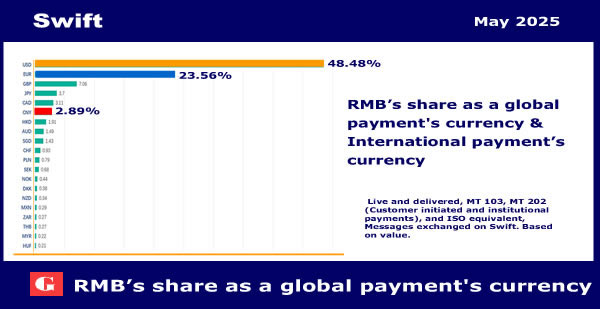

The U.S. dollar remains by far global predominant currency, which accounted for 48.46% of global payments, followed by the euro at 23.56%, according to Swift. But policy uncertainty from Washington has fueled a notable selloff in greenback, which saw its steepest losses of this year in April. Particularly in Asia, the region is gradually reducing its reliance on US dollar, driven by geopolitical tensions, shifting monetary dynamics as well as increased use of currency hedging.

Amid the environment of de-dollarization, China has been sparing no efforts to lay the groundwork to promote CNY. From expanding investment channels to building digital infrastructure, Beijing is devising more ways to attract foreign institutions to use CNY, which aims at challenging the dominance of greenback.

People’s Bank of China Governor Pan Gongsheng in a speech at the high-profile Lujiazui Forum discussed “how to weaken excessive reliance on a single sovereign currency.” He also announced plans to set up a center for digital yuan internationalization in Shanghai and promote trading of yuan foreign exchange futures. Beijing has already rolled out a digital version of its currency to replace some cash and coins in circulation.

Also three major Chinese exchanges announced that starting last week, qualified foreign institutional investors would be able to trade 16 more futures and options contracts listed in mainland China. In another step toward encouraging global investors to use CNY, the Shanghai Futures Exchange announced in late May it was gathering feedback for a proposal to allow foreign currencies to be used as collateral for trades settled in CNY.

Other recent moves, though incremental, include China allowing qualified foreign investors to participate in exchange-traded fund options trading from Oct. 9 for hedging purposes.

China appears to be accelerating its de-dollarization efforts. The data showed that CNY accounted for 2.89% of global payments by value in May. Related data also indicates strong inflows to CNY, expecting the trend will continue for the foreseeable future based on China's aggressive efforts to boost CNY.

Subscribe to Unlock this Article

Complete digital access to quality Glebors financial topic with expert analysis from industry leaders.

Glebors Financial Become an Glebors subscriber

Make informed decisions with the Glebors.Keep abreast of significant corporate, financial and political developments around the world. Stay informed and spot emerging risks and opportunities with independent global reporting, expert commentary and analysis you can trust.

- Financial reports are independent global financial research reports that you can trust. The information keeps pace with important companies around the world, global financial and political dynamics, independent insights and unique perspectives, helping you catch up with the latest information and identify the potential risks and opportunities.

- Our financial special reports use professional knowledge to fully understand the market situation, break down the perspectives of experts, and rationally analyze data to help you eliminate noise, accurately identify the changes in political, economic and social trends, and fully aware of the risks and grasp the opportunities.

- Our goal is to help shape the uniqueness of each research space we are involved in. Our research provides readers with new insights in terms of the global economy, financial markets, asset classes and risk management. We will continue to present new insights into global markets and industries.

"Insight of the global economy, dig into more ideas, analyze the global financial dynamics and the risks of political situation from a strategic, scientific and rational perspective, based on economic data and more than 20 years of financial intelligence."

Financial Reports

If you want to know more details to provide support for your investment and business activities, this financial report that we have selected for you can give you what you want, please subscribe to read it. Glebors Global Finance aims to provide business elites and decision makers with daily business news, data interpretation, in-depth analysis and commentary.

Glebors Global Finance’s amount of financial information digs into deeply major events and economic data that have a huge impact on the global economy, based on in-depth industrial research and special reports, with a truly global perspective。 Financial reports have become "must-read" financial information for senior managers. Gribs Global Finance currently has more than2.85 million Chinese readers and more than 3.5 million overseas readers, including more than 600,000 high-end member readers.